Urban informality generally refers to the processes, mechanisms, and practices of urbanisation that occur outside of and sometimes opposed to the formal mechanisms and regulations constituted by the state. In policy making, urban informality is traditionally conceptualised as comprising informal practices such as incremental housing and informal economies employing an informal labour force, which pitches informality as an antithesis of formality that can be understood only through the relational lens of a informal-formal dichotomy. However, boundaries between the informal and formal are never static and in practice, one can perceive the informal-formal as a continuum that has on one end the state constituting the governance and regulatory mechanisms that are highly formal, and on the other end everyday home-making and other life-sustaining practices observed by individuals, households, and urban communities that fall under the informal domain. This continuum can be perceived as a site of constant negotiation and struggle experienced by urban households living on the margins.

One of the ways to engage with this dynamic continuum is to populate it with the stories and lived experiences of the urban dwellers who successfully negotiate this space on an everyday basis. This article attempts to capture one such story of an informally employed low-income household who, with the help of informal financial agents, successfully navigated the informal-formal space of housing finance to finally buy a formal house of their choice. The article starts with contextualising the accessibility and affordability constraints for housing finance faced by low-income households. Following this, we discuss a case study of a home loan borrower in the informal sector, explaining the negotiations playing at the cusp of the informal-formal. Lastly, we deliberate upon the roles of lending institutions, specifically during the COVID-19 crisis and the financial recovery of the home loan industry in its aftermath.

Housing finance for low-income households

A low-income household is one whose monthly or annual income is below a certain threshold as prescribed by policymakers. In the context of Indian urban housing policy, the Ministry of Housing and Urban Affairs (MoHUA) defines different target groups such as Lower Income Group (LIG) and Economically Weaker Section (EWS) that are classified based on annual income. A household with annual income up to ₹3 lakh belongs to the EWS target group, and households whose annual income ranges from ₹3–6 lakh belongs to LIG. An academic paper published in the year 2020 by researchers associated with IIT Bombay suggests that households with annual income up to ₹90,000, categorised as Below Poverty Line (BPL) and accounting for 30.37% of the total population, are unable to meet their housing and housing finance needs through open markets and hence rely heavily on government support. Other low-income households meet their housing needs through housing markets either by accessing rental housing, buying a housing unit for home ownership, or incremental housing, i.e. home-building in a step-wise manner.

While renting needs a comparatively minor initial and temporal investment, purchasing a new home or expanding an existing housing unit requires a sizeable amount of investment. Buying a new housing unit needs long-term financing, either by formal sources like banks and housing finance institutions, or informal sources like private money lenders. According to a report published by the Small Industries Development Bank of India (SIDBI) in 2018 titled “Study on Informal Sector Lending Practices in India”, the average annualised interest rate charged by the informal money lenders was reported to be 36% that can go up to 90% as well in some cases. This rate is much higher than the interest rate charged by formal lending institutions, ranging from 7% to 12%, mainly for home loans. Therefore, on any given day, the first choice of any household for a long-term credit like a home loan is formal housing finance sources such as banks and other housing finance institutions. However, they face varied accessibility and affordability barriers stemming from the informal nature of their employment. We discuss these challenges and struggles faced by low-income households in the next section.

Accessibility Constraints

Formal housing finance institutions such as banks and housing finance companies (HFCs) tend to lower their credit risk by following strict lending criteria that require the households to have adequate income levels with a regular and verifiable flow of income. Procedurally, this criteria insists the applicants provide: (a) income proof such as salary slip provided by the employer; (b) bank statements to ascertain the level of cash flow in their account; (c) credit score such as CIBIL; (d) Income Tax Return (ITR) for last three years; and (e) guarantor who can provide security of repayment on behalf of the borrower. A closer look at these eligibility criteria indicates that they are tailored as per the credit profile of households with incomes above medium levels and formal employment, drawing a regular salary that their employer can easily verify. Households with informal employment, such as domestic workers, auto/taxi drivers, construction workers, contractual workers in hotels and restaurants, etc., therefore do not easily fit these eligibility criteria laid out by the formal housing finance institutions.

As per the International Labor Organization (ILO) report published in 2018, the informal sector in India employs 80.9% of the total Indian workforce. The aforementioned strict lending criteria formulated by formal housing finance institutions comes across as exclusionary to many households with informal employment. Adding to this is the lack of financial literacy of low-income households that prevent them from planning and observing good financial practices that negatively affect their credit profile. These factors collectively pose substantive accessibility constraints for the low-income households.

Affordability Constraints

Affordability in simple terms translates into ‘ability to pay’ and has a direct relationship with an individual’s income. In the Indian context, the Task Force on Promoting Affordable Housing (2012) prescribes that the housing can be deemed affordable for a low-income household if: (a) the ratio of house price to household income is below 4, i.e., the price of the house is below four times the annual income of the household; (b) the expenditure towards housing in the form of rent or home loan Equated Monthly Instalment (EMI) does not exceed 30% of the monthly household income. To put it in another way, the expenditure towards housing in the form of rent or home loan instalments should not exceed a certain threshold level such that the household is unable to devote sufficient money towards necessary expenditures such as food, education, health, and other daily needs.

Negotiating accessibility and affordability constraints

After facing the aforementioned accessibility and affordability constraints, many low-income households resort to various coping mechanisms to overcome them. We try to unpack some of those mechanisms by discussing a case study of the household employed in the informal sector. Mr Kumar (name changed) operates a tea stall near one of the industrial estates in Vasai in the Palghar district, about 65-70 km from Mumbai. A year back, his family decided to buy a house priced at ₹28 lakh, for which they were seeking to raise ₹15 lakh via a home loan. They applied to a nationalised banks where the family members had their savings accounts, but were denied on account of the informal nature of the tea-selling business as they were unable to qualify the strict lending criteria. Following this rejection, they approached a Direct Sales Agent (DSA) in their locality who promised to help them get the home loan in return for a commission. DSAs, also known as mortgage brokers in housing finance parlance, are independent entities engaged by banks and housing finance institutions for marketing (sourcing) home loans on a commission basis. They are the intermediaries acting as a bridge between customers and housing finance institutions (banks and housing finance companies) and receive a commission based on the home loan disbursed to the customers sourced through them.

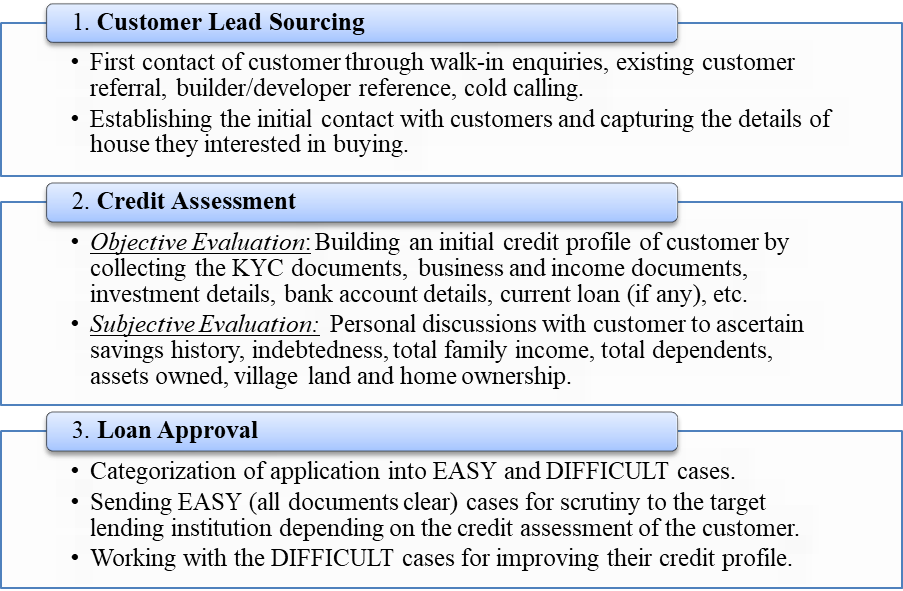

These DSAs undertake an in-depth credit assessment of the customers and try to build a creditworthiness profile for the customers. The DSAs make multiple personal visits at the business location and triangulation method to arrive at the income assessment for the customers who could not produce income documents. We interviewed ten DSAs based out of the Thane district and working in the affordable housing segment to understand their processes. The end-to-end process of home loan disbursement undertaken by DSAs from the initial contact with the prospective customer to the disbursal of loan takes the following stages:

- Customer Lead Sourcing: The DSAs source their leads at the local level through past customer referrals, references through developers, cold calling to make enquiries in the surrounding area of a new project and direct customer walk-ins at DSAs office. Customers usually approach DSAs when they cannot get a home loan directly through banks and large HFCs. During the initial interactions with customers, DSAs gather their livelihood details and information about the house they are interested in buying. Afterwards, DSAs make a rough estimation about the customer’s credit profile and try to identify a probable lending institution where the home loan application can be submitted.

- Credit Assessment: On an average, the DSAs undertake three to four meetings in a couple of weeks to perform the customer’s credit evaluation. The usual documents collected from customers include the Know Your Customer (KYC) documents such as PAN card, Driving License, Aadhar Card, Electricity Bill, Ration Card, and Birth Certificate. Additionally, for a salaried individual employed in the formal sector, other income documents such as Income Tax return (Form-16), bank statement, salary slip of applicant and co-applicant, appointment letter from employer, job experience letter, and bonafide letter from the employer is collected. For self-employed customers, the main document collected is the Income Tax return and the Company Registration Certificate. In the case of informally employed customers like Mr Kumar, other innovative means are used as discussed subsequently.

- Loan Approval: After deciding on the customer’s credit evaluation, the DSAs identify a suitable lending institution after comparing their lending criteria with the customers’ credit assessment report. The application containing all the objective and subjective evaluation documents is then forwarded to the concerned institution, independently validating all the information. After all the customer documents and property documents and verified, the home loan is approved, and further disbursal is processed. The DSAs receives the commission (0.25% to 1%) on the disbursed amount as per the agreement with the concerned institution. The DSAs are required to support the lending institution for at least one year for loan repayment post disbursal. For this period, the DSAs keep close contact with the customer and ensure that the customer is not defaulting on the repayment schedule.

In the case of Mr Kumar, he was asked to produce his street vending certificate, the raw material bills (milk, sugar, tea-powder, gas used), and a copy of the book/register where he kept all the records of sales. The DSA then undertook multiple personal visits at the business location and then triangulated various data points to arrive at the income assessment to ascertain the income. This was done by observing the hourly footfalls of customers at the tea stall to gauge the average sales and then subtracting the amount of raw material and other expenditures to arrive at the income earned. It took around three months for Mr Kumar and the DSA to complete the loan approval process of a cooperative bank, and finally, they got the home loan of ₹15 lakh. The DSA was paid ₹15,000 by Mr. Kumar and ₹7500 by the cooperative bank for all this process. After six months from loan approval, Mr Kumar applied for housing subsidy through the cooperative bank and availed ₹2.5 lakh subsidy under the Pradhan Mantri Awas Yojana (PMAY) Credit Linked Subsidy Scheme (CLSS). This subsidy resulted in an instant reduction of home loan outstanding and thereby reduction of home loan EMI. Thus, this process of accessing a home loan through a formal institution like cooperative banks enabled Mr Kumar to qualify for housing subsidy, which could not have been accessed otherwise.

Business entities like DSAs or mortgage brokers reduce transaction costs for lenders and save the borrower’s time and efforts needed for the application process. However, being a commission-motivated entity, the DSAs may prioritise their income over the best deal that may be suitable for the borrower. For instance, if a specific lender is providing more commission to the DSAs but charging a comparatively higher home loan interest rate to the borrower, there are chances that the DSAs will serve their interests rather than of the customers. We also found that in some cases, the DSAs charged an exorbitant commission to the borrowers under the pretext of helping them to get the home loan. Significantly, in the case of low-income households with low financial literacy, the DSAs can charge them more for the service they provide as the borrowers blindly rely on them and don’t have enough information to challenge the DSAs. Furthermore, the DSAs being a third party, have less skin in the game and have a very short-term and commission-oriented involvement in the whole transaction, which may be detrimental to the borrowers’ long-term interests.

To avoid these complications posed by the brokers, we found that some cooperative banks undertake this credit underwriting process without including the DSAs in the picture, thereby saving the commission payment. They employ a bottom-up approach for credit assessment instead of the top-down approach used by the mainstream financing institutions. The bottom-up credit assessment approach involves personal interaction with the customer and on the ground, on-field, real-time assessment of creditworthiness. This approach relies more on discovering repayment capacity than mere validation of income documents undertaken by mainstream financing institutions in their top-down approach. Thus, the DSAs and cooperative banks can be considered an essential link between the informal nature of the customer’s income and access to the formal financial sector.

Conclusions

The COVID-19 pandemic, which is far from over, has severely affected the Indian economy. Whenever faced with any short-term financial crisis, the first reaction of low-income households is to turn to cash reserves. For a long-term financial crisis like that induced by the pandemic, cash reserves are inadequate to cover the expenses, so they resort to distressed selling off assets like a bike, mobile, gold, land, etc. In this situation of limited income generation opportunities and rapidly diminishing assets, low-income household borrowers need immediate assistance on (a) managing the existing loans and (b) accessing new credit to sail over the financial crisis period. For this, the lending institutions where the low-income households have availed the credit like home loans or other loans can become a crucial partner for any policy response from the government. For instance, for managing existing loans during the post-pandemic crisis, the low-income households needed financial hand-holding and counselling to help them tide over this uncertain period of financial stress. We found that lending institutions and their employees were the ones who assumed this role of financial counsellor that enabled the customers to cope with the financial stress and anxiety emanating out of it.

Similarly, the localised nature of the DSAs and lending institutions like cooperative Banks is accommodating for lending new credit. It allows lenders to assess the creditworthiness of borrowers by engaging with them very closely. This closer interaction enables the lenders to look at the borrowers’ long-term earning capability rather than sticking to the stringent objective eligibility criteria for credit assessment. In conclusion, we foresee a crucial role of informal agents like DSAs and lending institutions more closely associated with and accessible to low-income households in post-pandemic financial recovery in the housing finance sector. Lending institutions like cooperative banks, Affordable Housing Finance Companies, and other micro-financing institutions will play a significant role in overcoming low-income households’ accessibility and affordability constraints.